Stock Capital Gains Tax Explained . a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. what are the capital gains tax rates? capital gains taxes are taxes you may pay on investments when you sell them for a profit. 6 things you need to know for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. Your capital gains tax rate. States with low and no capital gains tax;

from eqvista.com

a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. what are the capital gains tax rates? capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. 6 things you need to know for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. Your capital gains tax rate. States with low and no capital gains tax; capital gains taxes are taxes you may pay on investments when you sell them for a profit. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat.

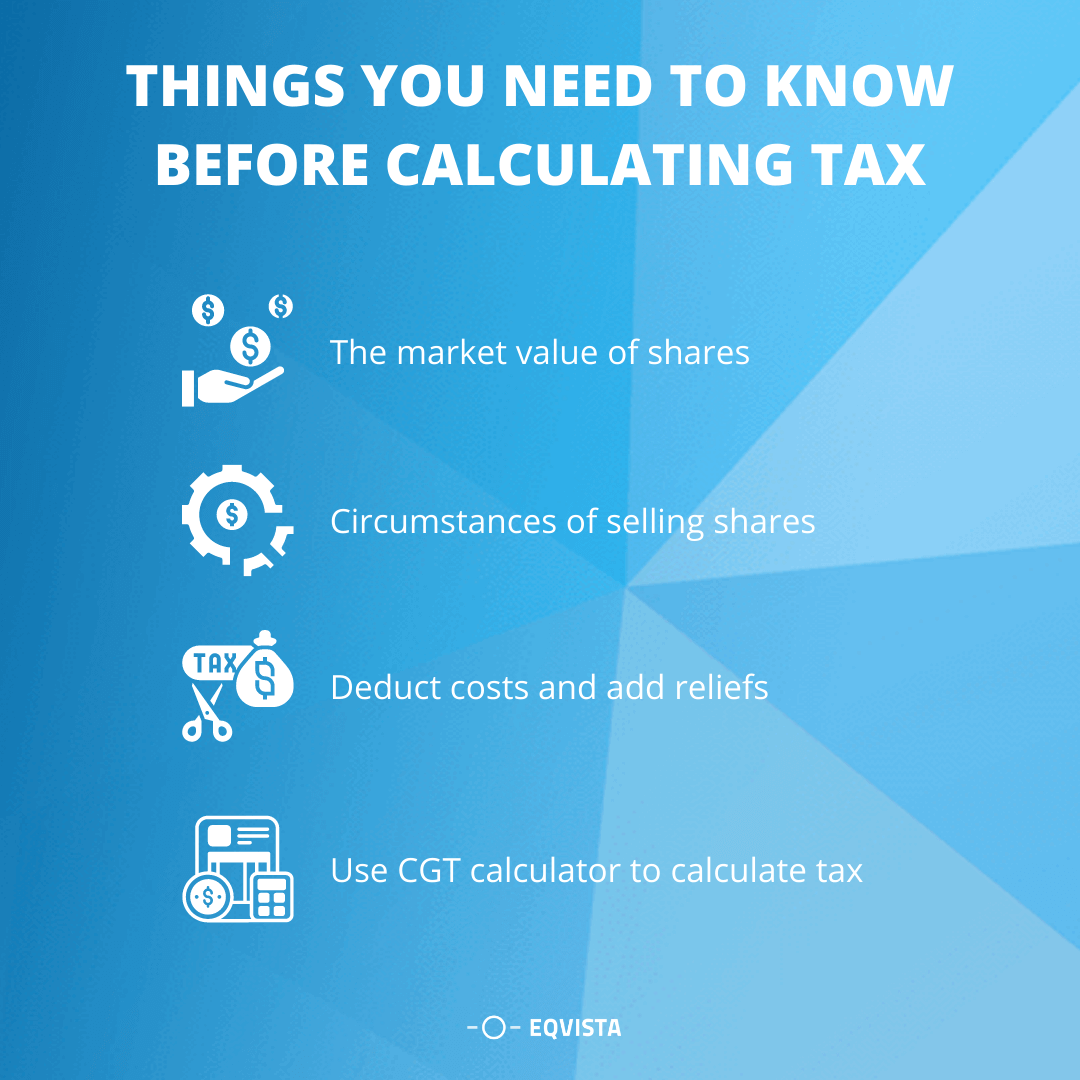

How to calculate capital gain tax on shares in the UK? Eqvista

Stock Capital Gains Tax Explained for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. what are the capital gains tax rates? capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. Your capital gains tax rate. 6 things you need to know States with low and no capital gains tax; capital gains taxes are taxes you may pay on investments when you sell them for a profit. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares.

From www.youtube.com

Capital gains tax on stocks explained Part 1 YouTube Stock Capital Gains Tax Explained a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Your capital gains tax rate. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. States. Stock Capital Gains Tax Explained.

From turneyfinancial.com

Capital Gains Taxes Explained Turney Financial Group Stock Capital Gains Tax Explained States with low and no capital gains tax; what are the capital gains tax rates? capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. capital gains taxes are taxes you may pay on investments when you sell them for a profit. Your capital gains. Stock Capital Gains Tax Explained.

From coingape.com

Capital Gains Tax Definition, Rates, Rules, Working Process & More CoinGape Stock Capital Gains Tax Explained a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. States with low and no capital gains tax;. Stock Capital Gains Tax Explained.

From mellisawpaola.pages.dev

Tax On Long Term Capital Gains 2024 Gail Paulie Stock Capital Gains Tax Explained Your capital gains tax rate. 6 things you need to know capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. capital gains taxes are taxes you may pay on investments when you sell them for a profit. a capital gains tax is a levy. Stock Capital Gains Tax Explained.

From kingavocadorecipe.blogspot.com

Capital Gains Tax They apply to most common investments, such as bonds, stocks, and property. Stock Capital Gains Tax Explained Your capital gains tax rate. for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. 6 things you need to. Stock Capital Gains Tax Explained.

From michaelryanmoney.com

State Capital Gains Tax Rates Navigating Zero, High, & Low Tax States For Financial Success Stock Capital Gains Tax Explained for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. capital gains taxes are taxes you may pay on investments when you sell. Stock Capital Gains Tax Explained.

From burnsandwebber.com

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns & ber Estate Agents Stock Capital Gains Tax Explained for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. 6 things you need to know a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. capital gains taxes. Stock Capital Gains Tax Explained.

From www.stockicons.info

50 best ideas for coloring Capital Gains Tax Stock Capital Gains Tax Explained capital gains taxes are taxes you may pay on investments when you sell them for a profit. States with low and no capital gains tax; what are the capital gains tax rates? 6 things you need to know a capital gains tax is a levy placed on profits from the sale of an asset, whether its a. Stock Capital Gains Tax Explained.

From www.ascpa.tax

How To Avoid Capital Gains Tax On Stocks Stock Capital Gains Tax Explained a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. capital gains taxes are taxes you may pay on investments when you sell them for a profit. capital gains taxes are the taxes you pay on profits made from. Stock Capital Gains Tax Explained.

From www.youtube.com

Capital Gains Taxes Explained ShortTerm Capital Gains vs. LongTerm Capital Gains YouTube Stock Capital Gains Tax Explained capital gains taxes are taxes you may pay on investments when you sell them for a profit. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. States with low and no capital gains tax; what are the capital. Stock Capital Gains Tax Explained.

From www.pplcpa.com

Series 3 Capital Gains Tax Rates PPL CPA Stock Capital Gains Tax Explained 6 things you need to know capital gains taxes are taxes you may pay on investments when you sell them for a profit. a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. a capital gains tax is a levy placed on profits. Stock Capital Gains Tax Explained.

From www.pinterest.com

ELI5 How Your Stocks Get Taxed (an Explanation of Capital Gains Taxes) stocks Capital gains Stock Capital Gains Tax Explained capital gains taxes are taxes you may pay on investments when you sell them for a profit. for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical. Stock Capital Gains Tax Explained.

From www.annuity.org

Capital Gains Tax What Is It & When Do You Pay It? Stock Capital Gains Tax Explained a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. 6 things you need to know Your capital gains tax rate. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like. Stock Capital Gains Tax Explained.

From thecollegeinvestor.com

Capital Gains Tax Brackets And Tax Tables For 2024 Stock Capital Gains Tax Explained capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. a capital gains tax is a levy. Stock Capital Gains Tax Explained.

From www.investopedia.com

Capital Gains Tax What It Is, How It Works, and Current Rates Stock Capital Gains Tax Explained States with low and no capital gains tax; 6 things you need to know a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Your capital gains tax rate. capital gains taxes are the taxes you pay on profits made from the sale of. Stock Capital Gains Tax Explained.

From www.stocksgold.net

How To Calculate Capital Gains Tax On Stock Sale Stocks gold Stock Capital Gains Tax Explained a capital gains tax is a levy placed on profits from the sale of an asset, whether its a physical asset — like a house, car or boat. for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. capital gains taxes are taxes you may pay on. Stock Capital Gains Tax Explained.

From moneyhandle.in

Capital gains tax (India) simplified Read this if you invest in stocks Stock Capital Gains Tax Explained States with low and no capital gains tax; Your capital gains tax rate. for the tax year 2024, those whose income is $47,025 or less do not have to pay capital gains tax. what are the capital gains tax rates? capital gains taxes are the taxes you pay on profits made from the sale of assets, such. Stock Capital Gains Tax Explained.

From amandiewlesli.pages.dev

Capital Gains Tax On Stocks 2024 Addy Lizzie Stock Capital Gains Tax Explained a capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Your capital gains tax rate. capital gains taxes are taxes you may pay on investments when you sell them for a profit. capital gains taxes are the taxes you pay on profits made. Stock Capital Gains Tax Explained.